How to calculate LTV for SaaS businesses

Don’t panic – There may be a lot of acronyms in the title but I promise this will be largely painless, and possibly even a little enjoyable! But before we get into the nitty-gritty, let’s rewind a little…

Every business needs to understand how much value each customer is bringing to their business. This helps them make financial projections and define future business goals. It also helps a business understand if their cost per acquisition of each customer is a valuable and sustainable investment for the business. But how can you calculate something that hasn’t happened yet? And how can you possibly know how long a customer will use your service? Enter: Lifetime Value (LTV).

Bamboozled by acronyms? Don’t worry, we’ve got you covered.

(Tip: Bookmark this page to refer back to it).

SAAS: Software as a Service

CAC: Customer Acquisition Cost

LTV: Lifetime Value

CCR: Customer Churn Rate

ARPA: Average Revenue per Account

MRR: Monthly Recurring Revenue

Before we get to the LTV calculation, we need to clarify a crucial data point: your customer churn rate (CCR). This is the rate at which your business is losing customers each month. This can be broken down further into proactive churn (cancellations) and passive churn (failure to renew). As your business grows, you will be able to identify patterns in the churn rate. Churn rate is the canary in the coal mine for SaaS businesses. If you identify a declining churn pattern, you need to take action.

Conversely, if you have a fairly even churn throughout the year you’re probably doing something right – keep up the good work! Most businesses will follow one of four churn patterns:

Declining: Steadily declining churn rate (starting at zero with churn increasing by 0.25% per month)

Constant: Steady churn rate across the months

Cliff: Most customers cancel after the first month, with a steady churn thereafter

Annual: Generally even across the months with large churn around annual renewals

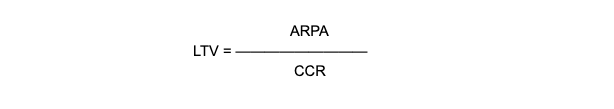

Simple lifetime value formula

The LTV formula is a helpful way for businesses to estimate the average gross revenue that a customer will generate while subscribed. Although LTV doesn’t address many important elements such as the fluctuation of the churn rate, or the growth or shrinkage of monthly recurring revenue (MRR), it is a far more effective method for garnering a rough estimation. In short, LTV helps us turn on the lights so we aren’t shooting in the dark.

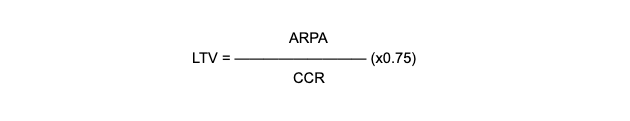

When calculating, it’s essential to select ARPA and CCR data from matching date ranges. It’s also important to note that the above formula is based on an assumed linear churn rate. Which, let’s be honest, isn’t real life! If you wish to create a more ‘realistic’ LTV, you need to use the below formula.

How to manage growth

The nature of business (good ones at least) is growth and expansion. It’s an ever-changing picture that needs to be constantly rebalanced. For some, this will happen rapidly, while others take a hare and tortoise approach. It’s important to update your LTV calculation along the journey to ensure you are using your customer acquisition budget as effectively as possible.

If you have a large user base and a wide range of LTVs it might be beneficial in the long run to segment these for LTV calculation. You can then tailor your efforts based on the most accurate LTV per segment.

Case Study: Three use cases for LTV

- Identify and refine: Calculating LTV across all your marketing channels can be an effective way to identify the most valuable platforms for acquiring customers. You can then refine your efforts and make your marketing spend work harder for you.

- Decrease churn: Decreasing churn is important for any business, but particularly for SaaS businesses. Use LTV to identify and segment your most valuable customers. These customers will have a higher average LTV and therefore have more impact on your MRR, so businesses should focus efforts on nurturing these relationships with special offers or increased customer care.

- Sustainability: An eternal dilemma for businesses: are you spending too much, not enough or just the right amount on customer acquisition? LTV can be an effective way of understanding how appropriate and sustainable your customer acquisition cost (CAC) is.